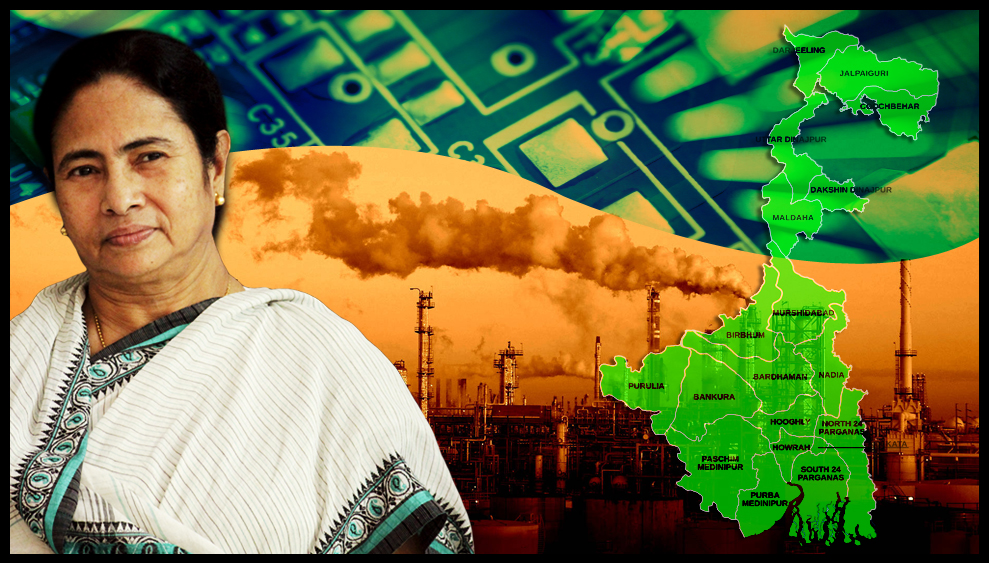

In the four years under Trinamool Congress, West Bengal Government has surged ahead, negating the misrule of the past Left Government. After formation of new industrial policies and creating infrastructure suitable for industries, Bengal is marching ahead towards a newer and brighter future. After the Bengal Global Business Summit and the visits to Mumbai, Singapore and Bangladesh by the West Bengal Chief Minister Ms Mamata Banerjee, investors have found faith in the State, which has all the criterion to be a key player to be in contact with the Far East.

Economic growth

When the new Government came to power in West Bengal in 2011, the fiscal condition of the State was in disarray. There was a huge debt burden of about Rs 2 lakh crores and the GSDP growth rate was way below national average.

However, in the last three years, there has been a remarkable improvement on the economic front. There has been a turn of fortune for Bengal’s economy under the leadership of Ms Mamata Banerjee.

West Bengal was able to raise its tax collection during a period of economic downturn and reduced profit margins for companies because of its e-governance efforts. By making every registered dealer who has to pay tax worth Rs 2 Lakh or more to make payments only electronically, government has succeeded in increasing compliance and there by plugging out possible channels of leakages.

The numbers say it all:

- The State revenue has gone up historically from around Rs 21,000 crore annually to around Rs 39,000 crore annually

- In FY 2013-14, GSDP growth rate was 7.7% vs national average of GDP : 4.9%

- In FY 2013-14, growth in agriculture and allied sector was 5.28% vs national average of 4.6%

- In FY 2013-14, growth in industrial sector was 9.58% vs the national average of 0.7%

- In FY 2013-14, growth in service sector was 7.8% vs the national average of 6.9%

- Total investment proposal received in the last 1000 days is in the tune of Rs 1,20,000 crore and the work in progress in the tune of 78,000 crore. Interested companies include SAIL, Ultratech cements, Reliance cements, ESSAR and others

- According to figures published by Department of Industrial Policy and Promotion (DIPP), in 2014, up to 31st October, the total investments implemented are in the tune of 3581 crore which is third highest in the nation

- In the last three and half years, total investments implemented is in the tune of Rs 7310 crore in “Big Industry”; compared to last 4 years of Left rule it is almost 2.5 times

- Creation of land banks, industrial clusters, clearance under 14Y has given a boost to Industrial growth

- 14 new IT hubs have been sanctioned. 117 industrial units have been allotted in the government industrial park

Growth of Capital and Plan Expenditure

In 2014-15 as per the new evaluation method, the Gross Value Added (GVA) of the State registered a 10.48% growth as compared to the country’s GVA of 7.5%.

Roads, bridges, drinking water, schools, colleges, hospitals, housing, etc. mostly rely on Capital Expenditure by the Government. When the Trinamool Government took office, there was a shock to find that in the year 2010-11 Capital Expenditure grew by Negative (-) 26.08%. In 2011-12, we were able to reverse this Negative into a Positive (+) 24.17% growth of Capital Expenditure. In the year 2012-13, Capital Expenditure grew by Positive (+) 64.53%. In 2013-14 the growth of Capital Expenditure is 52.33%. Such is the outstanding performance of this people centric Government.

Similar has been the record in Plan Expenditure Growth. When the Trinamool Government came to office, Plan Expenditure was a meagre Rs. 14,165.16 crore in 2010-11, which in a span of three years has nearly doubled (Rs. 28,159.37 crore).

Re-industrialization of Bengal is under way: Small, Medium and Large

Since May 2011 to December 2014, the total investment implemented or under implementation amounts to Rs. 84,211.85 crores. As a result huge employment opportunities are being created. In addition, investment proposals to the tune of Rs. 55,855.15 crores have been received. Another Rs. 2,43,000 crores worth of investment proposals have been received in the recently held Bengal Global Business Summit taking the total proposals on the table to around Rs. 3 lakh crores.(Rs. 2,98,627 crores). This investment will also generate huge employment opportunities. Bank Credit Flow to MSME has hit a record high between 2011-12 to 2013-14 reaching Rs. 40,713 crore, a growth of three times as compared to the corresponding before. The credit growth for 2012-13 and 2013-14 is highest among all the States.

There were only 54 MSME clusters when we came to office. Today this has increased by three times to 161 MSME clusters. This development in MSME will also generate huge employment opportunities.

Micro, Small and Medium Enterprises & Textiles

- Bank Credit Flow to MSME between 2008-09 and 2010-11 was Rs.14,557 crore, it is Rs.4,0713 crore between 2011-12 and 2013-14. In 2011, there were only 54 MSME cluster in the State. Now, there are 215. The number of Artisan Identity Cards issued has gone up from 33852 to 542909. Also, weavers identity cards issued have gone up from 0 to 531075

- Cluster development in 215 clusters was taken up for in MSME and textile sector

- Three regional level SYNERGY conclaves were successfully organized at Siliguri, Howrah and Malda for handholding support to MSME entrepreneurs

- Three Biswa Bangla Showrooms were opened at Kolkata Airport, Dakshinapan, Rajarhat and Kolkata International Airport. Three more showrooms at Bagdogra Airport, Esplanade and New Delhi will be opened shortly

- Biswa Bangla Marketing Corporation (BBMC) has been set up as an umbrella organisation

- The Indian Institute of Handloom Technology at Fulia started functioning from August, 2014. Skill upgradation training for 97,000 handloom weavers over the next three years has also started

- A Scheme of Approved Industrial Park (SAIP) with plug and play facility for MSME units has been introduced. A Venture Capital Fund with a proposed corpus of Rs. 200 crore has been formed

- Unique Clearance Centre (UCC) for fast tracking of land clearance was set up in Jalpaiguri, Bankura and Burdwan

- MSME Facilitation Centre (MFC) has been set up in 5 districts to provide single window services to all MSME entrepreneurs for statutory compliances and incentives

- During 2015-16, MFC will be set up in each district. 25 “Karma Tirtha” with project cost of Rs. 2.80 crore each will be set up in 11 backward districts under NFM

- Construction of Biswa Khudra Bazar planned over 50 acres of land at Santiniketan will soon start

- The construction of Eco Tourism Park being set up at Banerhat, Jalpaiguri will start in 2015-16. One Silk Park will come up at Malda and one Apparel and Textile hub will be set up at Rajarhat in 2015-16

- As against allocation of Rs.536.28 crore in 2014-15, an allocation ofe Rs.618.00 crore to this department has been proposed in the next financial year

- While the country performed abysmally with a 0.7% growth rate in the industrial sector, constant focus on the MSME sector has been a major factor in West Bengal’s achievement of a 9.58% industrial growth rate in the financial year 2013-14.

Large Industries

With the introduction of West Bengal State Support for Industries Scheme 2013, the State offers one of the most attractive fiscal incentives to manufacturing units.

13 Business Agreements (B2B) were signed in township, development, food processing, textiles, IT and civil aviation during the visit of Hon’ble Chief Minister to Singapore.

The Bengal Global Business Summit – 2015 held on 7th and 8th January 2015 has been a remarkable success. The State received investment proposals worth Rs. 2,43,100 crore at the summit. 20 countries participated and evinced keen interest to invest in the State.

The Government has taken up development of three new industrialparks at Goaltore, Haringhata and Haldia. Major industries like OCL, Xpro India Ltd., IFB Agro Industries, Utkarsh Tube & Pipes, Bengal Beverages have started commercial production in 2014-15.

To expand facilities for leather manufacturers, the Government has decided to notify Bantala as Industrial Township Authority.

In order to rejuvenate five tea gardens of WBTDCL, the State Government has successfully completed the process of private sector participation.

As against Rs.594.00 crore in 2014-15, allocate Rs.653.50 crore was proposed to Commerce and Industries Department in the next financial year.

Tax Reforms

The reforms in the tax administration have been widely acknowledged nationally with Commercial Taxes Directorate being adjudged FIRST among all states in the CSI-Nihilent e-Governance Award, 2013-14 and National Award on e-Governance 2014-15 in “Excellence in Governance”.

Increase in VAT threshold

The threshold of annual turnover for paying VAT is Rs. 5 lakh. The Government proposed to increase the threshold from Rs. 5 lakhs to Rs. 10 lakhs. Due to this measure, more than 20,000 dealers who are at present required to pay VAT will now go out of the ambit of Value Added Tax.

Amnesty Scheme for registration

The Government proposed to introduce an attractive amnesty scheme for unregistered dealers for registration upon payment of reduced tax on their self-declared turnovers for past periods without payment of interest and penalty. The scheme opened from 01.04.2015 till 31.07.2015.

Settlement of Dispute Scheme

With a view to provide relief to the dealers of their unpaid past liabilities and to reduce pending cases, the Government proposed to introduce a very attractive Settlement of Dispute under which the dealers can honourably discharge their past liabilities by paying a fixed percentage of past dues with full waiver of interest and penalty for assessment cases pending in appeal or revision as on the 31st day of January, 2015. The last date for making application for such settlement will be 31st July, 2015.

VAT audit relief to MSME

Audit report by a chartered accountant has to be compulsorily filed by the dealers. We had earlier provided relief to small dealers by gradually increasing the threshold from Rs. 1 crore to Rs. 5 crores. For the development of MSMEs and small dealers of the State, it was proposed to increase the threshold from Rs.5 crore to Rs.10 crore.

The dealers with annual turnover of less than Rs. 5 crores are required to file a self-audit statement. It has also been proposed to do away with filing of self-audit statement by dealers with an annual turnover of less than Rs. 10 crores.

Simplification of assessment

The far-reaching changes in the assessment procedure have reduced assessments from 1,73,588 in 2011-12 to 40,493 in 2013-14, a whopping 300% reduction.

It has been proposed that no demand above Rs. 20,000 can be raised unless the dealer is be given an opportunity to present his case on receipt of the gist of the proposed demand. This will reduce litigation and also provide relief.

At present upon disposal of an appeal petition, the case is sent back to the assessing officer for issuance of a revised demand notice, thus causing delay. It has been proposed to issue a revised demand notice along with the Appellate Order itself.

Speedy tax refund

Earlier, VAT refund used to take 8 to 10 months which the present Government has brought down to 1 month. The simplification of refund procedure has resulted in more than eight times increase in number and fourteen times increase in quantum of pre-assessment refunds. This is remarkable achievement in the area of VAT Refund.

Now, it has been further proposed to provide for grant of post-assessment refund within one month of issue of the assessment order and dispose of all pending cases within September 2015.

Extending the scope of pre-assessment refund

At present dealers are not entitled to preassessment refund if the combined export and inter-state turnover exceeds 50% of the total turnover. Now, the Government proposed to allow the benefit of refund to dealers whose combined turnover of export and inter-state sales exceeds 50% of the total turnover.

Easy Profession Tax registration

Profession Tax enrolment is required for submitting online application for VAT registration. The Government has proposed to merge the two processes through an integrated online system whereby a dealer can simultaneously obtain Profession Tax enrolment and VAT registration. It also proposed to grant new VAT registration within 24 hours for all online application made using Digital Signature.

Merger of Profession Tax set-up with Commercial Taxes

During the last year major structural reforms were introduced in profession tax through rationalisation of tax slabs from more than 100 to just 4.

The Government has now proposed to merge the Profession Tax set up with the existing Commercial Taxes Directorate. This will hugely benefit the prospective tax payers who will now have to deal with only One Tax authority in place of two.

Stamp Duty Relief for Property Registration

At present 1% additional Stamp Duty is charged on properties whose market value exceeds Rs. 30 lakhs. The Government has proposed to raise the threshold from Rs. 30 lakhs to Rs. 40 lakhs with immediate effect. As a result, the property owners will have to pay reduced Stamp Duty of 6% instead of 7% on properties with market value up to Rs. 40 lakhs.

Extending Industrial Promotion Assistance Scheme

The Industrial Promotion Assistance Scheme for financial assistance to micro and small enterprises comes to an end on 31.03.2015. It has been proposed to extend the scheme for a further period of one year up to 31.03.2016.

Transformation in Public Finance

West Bengal has gone through a significant transformation with the public finances. The state of the public finances was in a dilapidated condition when Mamata Banerjee took over as the Chief Minister of West Bengal.

Figures clearly show that the State’s fiscal measures have borne fruit:

- Revenue Deficit (difference between budgeted net revenue and actual net revenue) which was 3.6% (2010-11) has declined over the years. It was 2.7% (2011-12) to 2.1% (2012-13) and is projected at 0.5% (2013-14). The Revenue Deficit has sharply fallen from Rs 21,578 crore (2009-10) to Rs 13,308 crore (2012-13) and to Rs 3,488 crore (2013-14)

- Gross Fiscal Deficit (difference between government’s expenditure and revenue expressed as a percentage of GDP/GSDP) which was 4.4% (2010-11) has also declined over the years. It was 3.3 % (2011-12) and in 2013-14, it is projected at 1.8%. In the non special category states, in terms of Gross Fiscal Deficit, West Bengal had second highest GFD (2011-12), while in 2013-14, 6 states are above WB

- The state’s own tax collection has increased historically. It was at Rs 22,000 crore (2011-12) and increased by more than 40% in 2012-13 and to Rs 39,100 crore (2013-14)

- Capital Expenditure Disbursement (it is the expenditure on development of machinery, equipment, building and other infrastructure) a greater growth of infrastructure like roads, bridges etc) grew by 44% in 2012-13, from Rs 10,505 crore (2011-12) to Rs 15,137 crore (2012-13) and further to Rs 18,914 crore (2013-14)

- The ‘Development Expenditure’ (as defined by RBI) has increased from 52% (2011-12) to 57% (2012-13 and 2013-14)

- The ratio of own revenue generation to the revenue expenditure has significantly increased from 35.8% (2011-12) to 39.8% (2012-13) and to 45.2% (2013-14)

Note: The figures of 2010-11 and 2011-12 are actual figures while figures of 2012-13 are Revised Estimates and 2013-14 are Budget Estimates.

Inclusive growth – Bengal leads the way

While the State’s GSDP has been growing at a much higher pace than the national GDP and the state revenues have grown historically by more than 85% in just 3 years, it is also the backward class which has perceived the growth. It is only when the backward class, economically and socially challenged sections are given the benefits of the growth, development becomes inclusive and holistic.

Development of the backward class and the socially challenged class has received a huge boost under the government led by Mamata Banerjee, as shown in the charts below:

Planned Expenditure

The planned expenditure has grown from Rs 391.85 crore to Rs 610.85 crore, in the last 3 years under Trinamool’s rule compared to the last 3 years of Left regime.

Bengal’s debt conditions improves

The Debt-GSDP ratio was 44% in 2008-09 and 2009-10 has decreased sharply over the years. It stands at 40.1% in 2011-12, 37.5% in 2012-13 and at 34.6% at 2013-14.

Interest payment to GSDP ratio has fallen down from 3.8% (2005-06 to 2009-10) to 2.8% (2010-11 to 2013-14).

Interest payment to revenue receipts has also decreased from 37.9% (2005-06 to 2009-10) to 25.8% (2010-11 to 2013-14). Revenue receipts means the taxes, duties and fees levied by the government and also includes interests on investments made by the government or dividends earned by the state.

The growth of GSDP (g) is higher than the effective rate of interest (i), ie g-i >0. In WB, g-i, is now at 8.3(2010-11 to 2013-14) and has increased from 4.6 (2005-06 to 2009-10). If GSDP grows at a higher rate than the effective rate of interest, then it reflects a better situation of public finance. The surplus has grown sharply over the years.