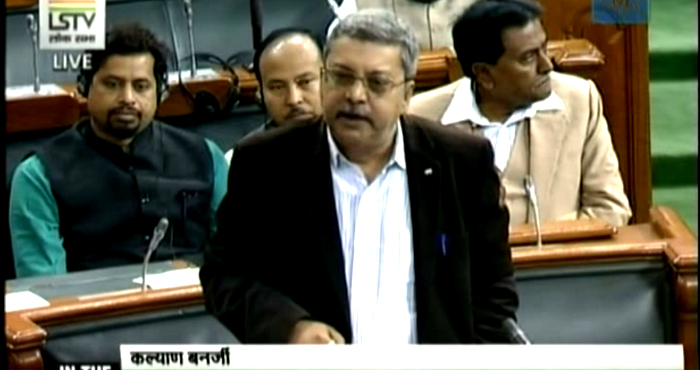

FULL TRANSCRIPT

Sir, I do not know from whose mind it has come and it has been changed, but I give you thanks for Clause 2, that is, the extended meaning, after the words “the area of a Customs station”, the words “or a warehouse” shall be inserted. And in your objects and reasons, you said that, in Clause 3 … it is proposed to amend this again to include ‘warehouse’ in the definition of ‘customs area’ to ensure that an importer will not be required to pay the proposed integrated goods and service tax at the time of removal of goods from customs station to warehouse.

This grey area existed for a long period of time and so many interpretations have been made but today you have really clarified and have made a very definite definition and that’s the reason I feel that this part is really very good.

I would like to come to the next point, which is Clause 3, 108A. A person who is responsible for maintaining records of registration or statements of account holding, any other information – it is a liability that they have to maintain this. My second point is about the part where the proper officer considers that the information furnished under sub-section 1 is defective. I would like to know, who is the proper officer? This proper officer has not been defined. You cannot appoint a ‘proper officer’ according to your wish and terms, by any notification.

So far, you have given a chance of giving a reply to them, in case of any defect. But so far 108B is concerned, where you have imposed that if you fail to give the information to the proper officer, every day they have to pay a fine of only Rs 100, which, according to me, a lesser punishment. The punishment should be increased. Why would an authority specified under 108A (1) be failing to discharge statutory duties? If someone fails to discharge statutory duties, that person should be penalised more. All high-ranking officers have been defined under 108 (a) and they are been paid by the State Exchequer, so should they be committing any delay? If they delay, why should there be only a Rs 100 penalty? Why should you not start disciplinary proceedings against them? Why should they not be liable? The officer should give the information immediately. If the penalty is not increased, nobody would be aware of the implications of these statutory things. The officers are bound to do it.

Now, I point out to you the Central Excise Act, as far as Clause 8 is concerned, where the Section A has been amended and Section Survey inserted; wherein, in respect of any goods, if the Central Government is satisfied that the duty to be levied under Section 3 may be increased and that circumstances exist to render immediate action. I say this is an excessive delegation. There cannot be arbitrary exercise of power. In law it is said that absolute power corrupts absolutely. Now, why should you give such an unlimited power, unlimited discretionary power? What are the objective determinations behind the purpose of that? This part gives excessive power, excessive delegatory power, and hence is capable to be abused. Now, so far this part is concerned – Part 3 (b) (i) – this, according to us, gives excessive delegatory power. This should not be there. We are all for constructive criticism; but we are not as such opposing the Bill.

Sir, we understand, this is the Bill and it is the consequential one; these four Bills which have been given in the list, and these Bills are needed. Despite our objections and our Amendments, we have to accept whatever is there, excepting a few things which I have pointed out, and I hope the Hon. Minister of State, who is here, will take care of the points which I have said. You have to understand what the stark reality is at the ground-level. The stark reality is the power with the Central Excise officers, the customs officers, police, etc. If you give them absolute power, with no restrictions, then that power will be abused. Therefore, I request you to keep some safeguards there. One who has committed a fault should be penalised. In my speech I have said so. However, no officer should arbitrarily exercise power. Kindly keep this safeguard in mind.

With this I end my speech.