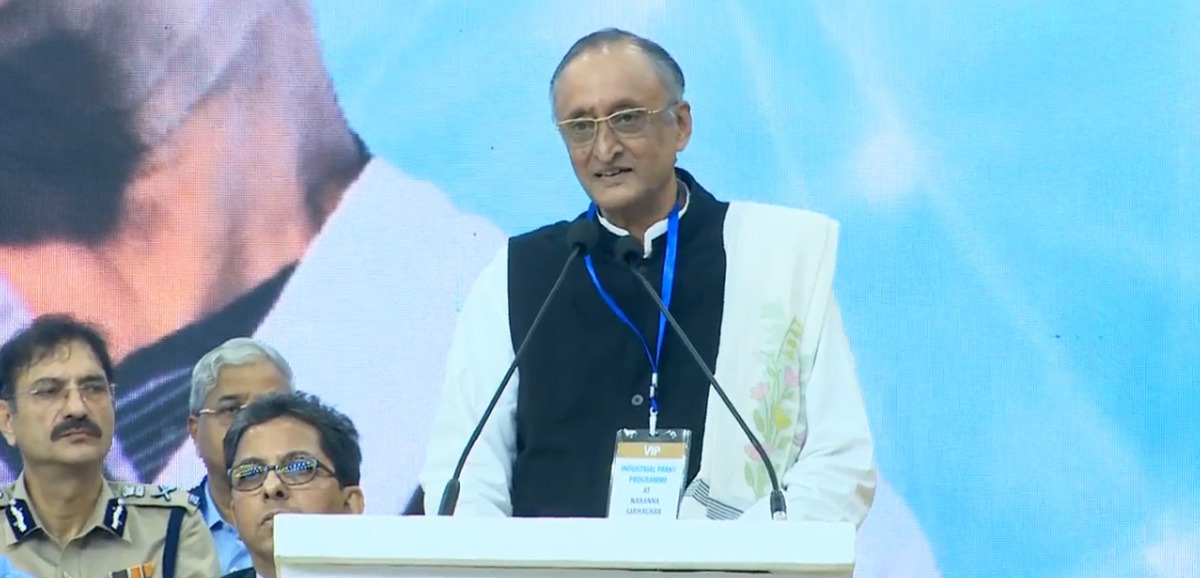

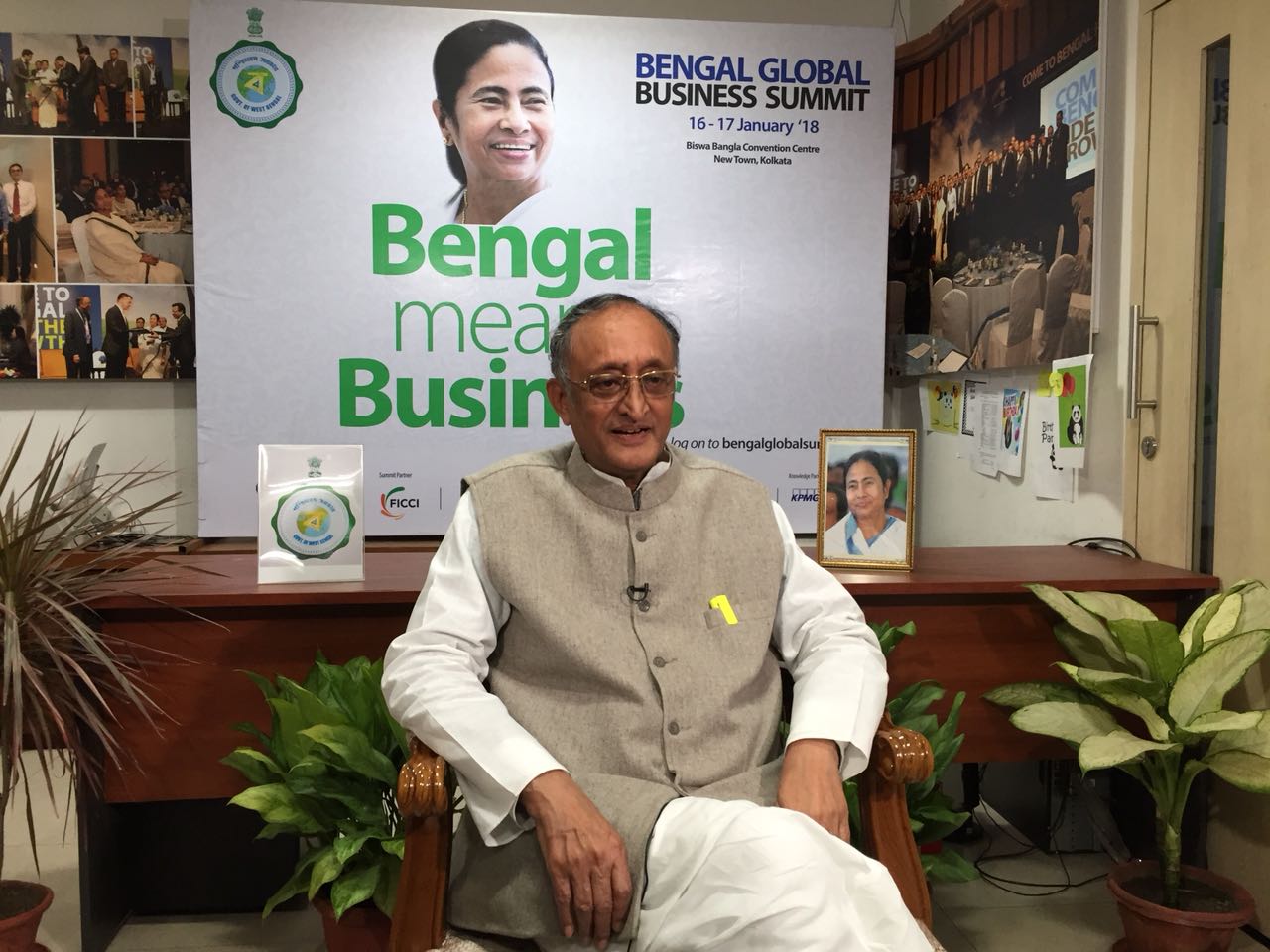

Dr Amit Mitra, Honourable Ministry for Finance, Commerce and Industries, West Bengal Government, in conversation with CNBC TV18 anchor Shereen Bhan

On past BGBS Summits

I think it is important for us to take a look at the three summits that have taken place: 2015, 2016 and 2017. I want to tell you that I am so delighted that close to 50% of the projects proposed are on the ground today. Mamata Banerjee, in fact, speaking in the concluding session, mentioned this specifically, because we are looking at implementation, not of offer only.

I know another State that I don’t want to name, two summits before they had 1.4% of their investment offers fructified. The minute the summit gets over, our entire team and department sits together and every month they have to explain how much of this has been done, and Mamata Banerjee herself takes a meeting every three months, saying, “where are we?” So result of that is, close to 50% of these three summits, this being the fourth has in fact fructified on the ground.

The result of that is that our GDP growth is phenomenally higher than India. Our GDP has more than doubled in 5 years, from 4.5 lakh crore to 10.5 lakh crore. Obviously investment is happening. Keynesian multiplier effect is happening. But we have to take it deeper.

And this year’s summit, as you know, was the creme-de-la-creme. I mean Mukesh Ambani, Lakshmi Mittal, Mr. Jindal, who opened his plant for cement, inaugurated by Mamata Banerjee day before. 2.5 million tons, going to 5 million tons. He said he will double in one year. So that is an example that things are happening.

Does anybody know that 1 billion USD has been invested in a fertilizer plant, the only plant in the world using coal-bed methane, in West Bengal. Rs 7,700 crore on the ground.

On BGBS 2018

There are two elements for this year’s summit which are really interesting. One is, out of the 2.2 lakh crore offered, majority of it is in manufacturing and infrastructure. That means Bengal is rising. It used to be the manufacturing capital of India, competing only with Maharashtra at one point of time. This is very interesting to me, that much more than half, 1.5 lakh crore is in manufacturing and infrastructure, which are asset creating.

The second element of this time’s summit is jobs, jobs and jobs. I mean, imagine, the Kanpur leather people came and signed an MOU and said, “We want to come to Bengal, and we are going to give you 1 lakh jobs”. Now that is something stunning. Mr. Mukesh Ambani said that “I am going to invest 5000 crore and I am going to provide 1 lakh or even more jobs”. Jobs. So labour intensive sectors, whether it is leather, gems and jewellery, whether it is food processing.

So the two elements are: on one hand you are manufacturing, which is the predominant offer of investment. Pranab Adani said,”This is what I am going to do” and Jindal has already done so. So jobs on one hand and manufacturing and infrastructure on the other. This is the winning combination along with the fact that 9 countries became partner countries spontaneously. We have no danda. It has to be spontaneous. China came with a big delegation.

On Bengal’s economic potential

Let me tell you, the export from Bengal in 2016-17 has 8.5 billion USD. Now, quite a bit of that export is an integrative export with the North-East. Bangladesh today is working with us. Nepal, Bhutan. And now the new development in this summit was the fact that from ASEAN the largest industrialists of Thailand, Mr. Aloke Lohia, 7.5 billion USD turnover, was here in this summit.

These are things we have never seen before. Therefore we are reaching into the ASEAN territory for investment reaching into West Bengal which then goes back and exports to us here. So I think things are beginning to move. Now Poland becomes a partner country. Why? They are from outside of this region. Because they have the deepest mines in the world – 1,200 metres deep coal mine and 1,400 metres deep copper mine. We have the world’s second largest coal deposit – at Deocha-Pachami.

So there’s a synergy there. It is not only this region. We are seeing synergies with many Europeans who have come as partner countries, and not just saying in words – Italy, France, Germany Poland, Czech Republic and the UK. A governor from South Korea has come, whose state has the largest steel-producing plant in the world and the largest petrochemical plant in the world. He comes here with a big delegation. Why? Because we are becoming the hubs for these kinds of industries, which would then connect us with the ASEAN countries and everybody else.

ON GST returns

Let me submit to you that I have written a formal letter to the Union Finance Minister, since I couldn’t be there, giving exact details let me tell your listeners that the GST Network was to process 300 crore invoices per month, or 30 billion. Can you imagine that? Now obviously, the system is not working. The small and medium enterprises are not able to uplink. Every state is being compensated by the Centre because they are not being able to reach the 14 per cent rate of growth.

Now West Bengal is doing better, it is being compensated by a small amount because we have completely digitised. So our people could migrate more easily but the small and medium enterprises are in a very bad shape. I had repeatedly said to please not to launch GST on July 1 because you are not prepared. You had done a beta test on 200 companies per state, and 30 per cent of those tests have failed.

Forms… You have GSTR-1, GSTR-2, GSTR-3, and you have GSTR-3b, which is a kind of a small form. So the question is very simple. It is a question of converging them into one. The idea is to converge in a manner that it is uplinked successfully. Why are the states not getting any taxes through GST? Most of their taxes have gone up – some have come down, some have gone up – because it is a complete mess. First you introduce three forms, you fail, then you introduce one single form which is supposed to be good but people are not able to uplink.

Now my question is, is this the way to do the world’s largest fiscal reforms? You do tryst with destiny in the Central Hall of Parliament on July 1 but the systems are not ready. I said repeatedly on July 1. A lot of finance ministers have come privately, including some BJP ministers, saying you are right, let’s fight to see if we can get a better deal for our small and medium enterprises.

On the E-Way Bill

You may be interested to know that West Bengal has an electronic E-Way Bill for which we have no check posts for the last two years – 1 per cent entry tax, self-declared, electronically carrying it with the driver – no checkposts. Now ours is one of the most successful electronic models which you are calling the E-Way Bill. So we don’t have a problem. But do you know the status of the whole of the north-east with respect to the E-Way Bill. At least five larger states don’t have E-Way Bill.

Now look at Bihar. They have checkposts, there were different rates for entry taxes earlier – they have huge corruption, according to their own former Finance Minister who is now the Deputy Chief Minister. He called me up to ask me as to how are you able to manage this in an electronically?

Absolutely, I support the E-Way Bill because we have experimented with it and we are successful. But the problem is that there are many states which are not prepared. Has there been a white paper on that? Has there been a white paper on GST as a whole? At least respect the GST Council and present a white paper, saying that this is the state of things. As far as the E-Way Bill is concerned, we are way ahead of the E-Way Bill. We are doing it for the last three years. But are all states ready?

February 1 is a good date. But I would say, empower the states to be able to implement it. The, please don’t forget the Inter-State Way Bill, which is supposed to be implemented from June 1. Can you imagine what a mess that can make? Every 20, 30, 40 km, you’ll be stopped and electronically checked – is that a simple system? But at least we have to work towards it. Where is the white paper on that? What will happen to the whole north-east – seven sister states and Sikkim? What would happen to at least five other states whose Finance Minister are telling me we are not yet ready? So we have to work together in the way federalism is talked about by the Centre.

On GST Council Meet

I just said that even without knowing the outcome the returns are in a mess and so I fully understand why they could not come to conclusion, because you have three different forms and then you have a fourth form. Now you cannot uplink 300 crores in a month. The GST is not ready, so you can have a video conference, fine. But are we ready, we have to proceed on this. If you do this on a hurry, on July 1, without knowing what unchartered process you are going into, like demonetisation, unfortunately the revenue of States will suffer, Centre will forced to compensate them as per Constitutional requirements, Centre’s own revenues will be at risk and fiscal deficit will become a challenge for the Centre.

On GST revenue collections

See, if you look at July, our revenue collections were pretty reasonable, it started coming down, in October it fell to Rs 83,000 crore. Now if you look at the Gujral Committee report to the Parliament, you will find that the Gujral Committee says that even for exports, exporters earlier did not pay any taxes, they just filled the ‘H’ form. Now they have to first pay taxes and the seek refund and do you know that Rs 40 crore per company of the medium sized companies are stuck with the government, not getting refund. So the exports are going to suffer badly.

It has already started and the Gujral Committee report to the Parliament already says October was terrible. And they say from 15% being blocked, if it goes to 20%, you are on danger line and the biggest question your listeners must understand that the minute you cannot get that refund from the government, your working capital goes down and who gets hurt, the contract workers, the job workers. In West Bengal, my Gold job workers have lost their job because the companies are stuck with their refunds with central government. This is terrible.

So it’s going to hurt exports, it’s going to hurt common small businesses. Please do something about that. I’ve written all these in my letter.

On Union Budget 2018-19

Well, I can only say, that, during this period since demonetisation, your GDP growth rate has fallen, fallen, fallen. Four year’s low. At the same time due to the introduction of GST after demonetisation, we are stumbling. Do you know that gross capital formation grew by 0.59%? That is, investment grew by less than 1%. So what is he going to do in the budget? It is going to be populist budget, because it is the last budget, before the elections. So, let’s give away money and have a problem with the fiscal deficit, revenue deficit issues.

On Govt borrowings

What I’m saying to you is FRBM act, which restricts your borrowing, we as states are sticking to FRBM. Centre does not have any FRBM. It may be saying this today, but you know what happens in reality, you augment borrowing. You announce something, over time you realize you can’t do it, then you start borrowing; you break the FRBM limit because they don’t have FRBM limit but all states do.

I cannot pass my FRBM limit, which is 3% of GDP, but they don’t have any FRBM limit officially passed by legislature. Therefore my concern is, this is show of saying we will borrow less, but when it comes down, I will give my guarantee, and will come back and see in six-seven months times, when we talk again that they are borrowing immensely. The banks are in bad shape you know that. Non Performing Asset levels are very high. So the Union Finance Minister has to handle this- low growth rate, low capital formation, banks in bad shape in terms of NPAs. Where is he going to get the money from? Then you need a populist budget for electoral purpose which means more spending. To me, I would hate to be in his shoes.

On priorities of Bengal Govt

Well I think Mukesh Ambani, Mr. Jindal, Mr Adani they didn’t come to this conference because they had some reason to come excepting for their trust of Mamata Banerjee. Top CEOs have to trust their leader, they have to trust the transparency.

Mukesh Ambani said he intended to invest Rs 4,500 crore in Bengal, but actually invested 15,000 crores. Then he promised Rs 5,000 crore of more investments in the summit. I’m sure if you go by the past records it will grow up to Rs 20,000 crore. Even hand-set manufacturing will be done in West Bengal, he said.

So, what I’m saying to you is our growth rate is much higher than India, our capital formation has grown by 7.5 times, asset creating permanent structures and taxes have doubled, which is record in India because of e-taxation for which the central government has given West Bengal an award 10 days ago. The Union Government gave us an award for e-taxation being number one among 24 states.

We will have to leave at that, Sir. Thank you for your time.