April 1, 2015

KMC achieves historic success on Property Tax initiatives

Kolkata Municipal Corporation under the leadership of Mayor Sovan Chatterjee has decreased the property tax rates for the poor slum dwellers, middle class and lower middle class income group. Legal actions have been taken against those who have been avoiding taxes. Administrative reforms, easier tax payment procedures have helped KMC to significantly increase the revenue from property tax.

In the last five years Kolkata Municipal Corporation has taken a number of effective steps to give tax reliefs to slum dwellers, middle class and lower middle class.

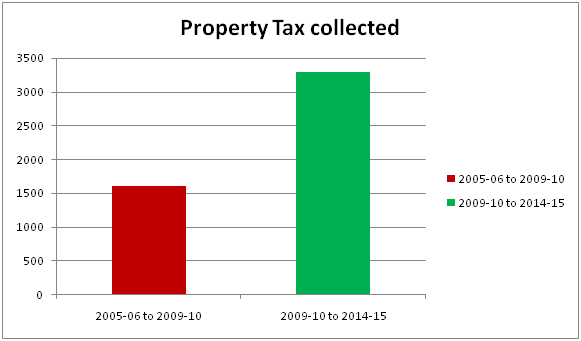

Between fiscal year 2005-2006 and 2009-2010, the property tax earned was Rs 1605.67 crore. In the tenure of the present Kolkata Municipal Board the property tax collected has been Rs 3291.74 crore, out of which Rs 340 crore was earned due to the waiver scheme.

Other significant steps include:

- Certificates to thika Tenants: Kolkata Municipal Corporation along with Government of West Bengal jointly has for the first time taken steps to provide certificates to thika tenants. If the certificate is in the name of the thika tenants, then it will be very easy to make mutation and take necessary permissions for reconstruction, renovation and re-modelling.

- Waiving of Interest: For economically backward section who have failed to comply with taxes and interest and penalties, due to financial reasons a waiver up to 50% of the interest is provided.

- E-Governance: Various administrative steps have been taken to make tax payments easier. Citizens can visit the KMC website and check the tax due, pay taxes, download forms.

- Mutation: In the last five years various mutation camps have been organised for faster mutations. Apart from this, in various unit offices, ‘one visit mutation counters’ have also been opened. More than 5 lakh mutations have been given in the last five years.