Bengal is surging ahead. The recent figures make it clear that Bengal offers a golden investment opportunity. Under the leadership of West Bengal Chief Minister Mamata Banerjee, the Bengal Global Business Summit 2016 will bring together policy makers and business leaders from India and abroad to stimulate further investments, growth and development in Bengal.

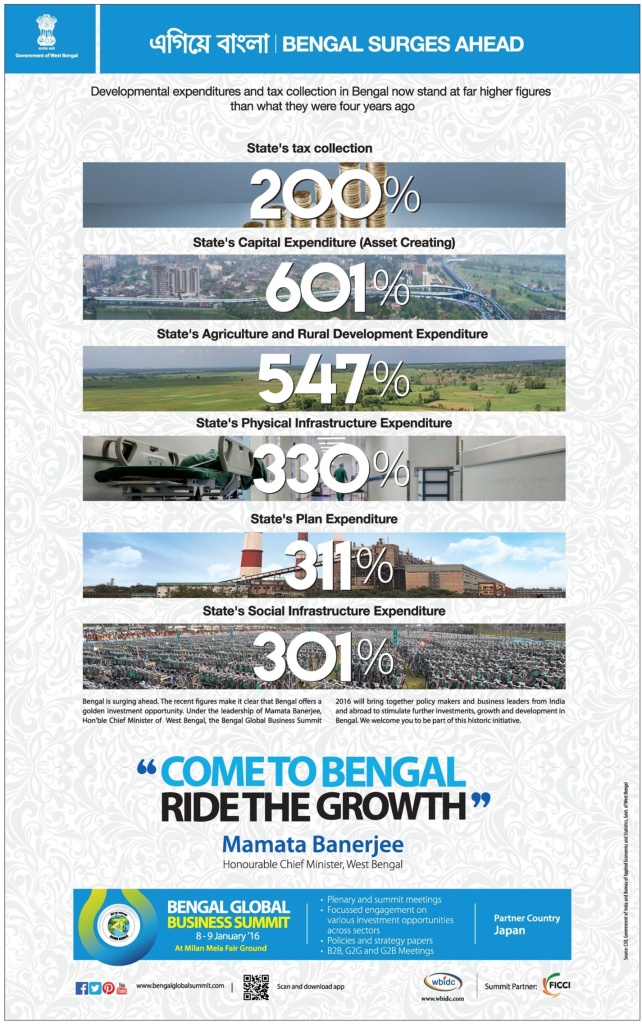

The developmental expenditure and tax collection in Bengal now stand at far higher figures than what they were four years ago.

During the last four years:

• Bengal’s tax collection has increased by 200%

• The State’s Capital Expenditure (Asset Creating) has increased by 601%

• The State’s Agriculture and Rural Development Expenditure has increased 547%

• The State’s Physical Infrastructure Expenditure has increased by 330%

• Bengal’s Plan Expenditure has increased by 311%

• The State’s Social Infrastructure Expenditure has increased by 301%