West Bengal Finance Minister Dr Amit Mitra presented the Bengal Budget 2015 today at the West Bengal Assembly. Making a large leap this Financial Year, Bengal Government is aiming to jump a growth of 10.48% GSDP in 2015-16.

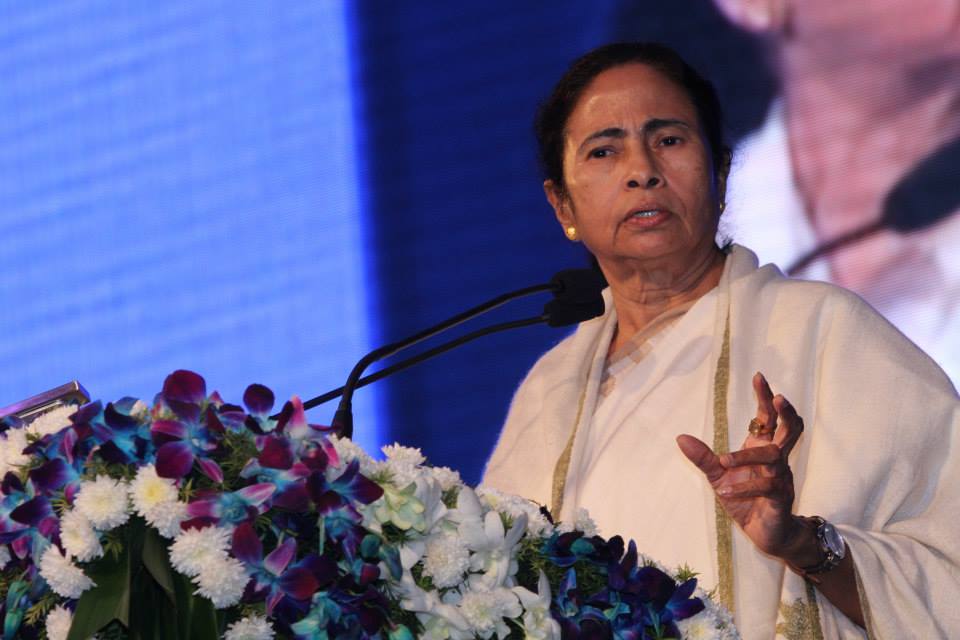

In a press conference after the announcement of this years budget the Chief Minister proudly said: “This is a people’s budget. This was a Budget for Maa, Mati, Manush.”

Here are the highlights of Dr Amit Mitra’s speech:

- Maa Mati Manush has confirmed their faith on our leader Mamata Banerjee time and again, Bengal economy is moving in a new direction

- Bengal’s Gross Value Added Growth is 10.48%, while for the Nation it is 7.5%

- Capital Expenditure growth: In 2010-11 it grew at a negative 26%, in 2012-12 positive 24%, 2012-13, positive 63% and in 2013-14 positive 52%

- Planned Expenditure has been a record double in 2 years

- Bengal has a huge debt, in 2013-14, Rs 28,000 crore deducted

- In the last 3 years more than 1 lakh crore has been deducted from the treasury

- Food and storage capacity has been raised 9 times in last 3 years from 40,000 MT

- 95 Kisan Bazars have been planned, 84 are already running

- To protect Food Security, 91,000 false ration cards have been cancelled

- The number of digital ration cards have touched 7.8 crore numbers. This is an unprecedented success

- West Bengal secured the top position in the 100 Days Work Scheme

- The State Govt set up 25 lakh toilets in the last 3 years in households and schools

- In Nijo Bhumi Nijo Griho scheme, 2 lakh 30 thousand pattas were distributed

- For the economically challenged section, we have been able to increase the housing by 3 times

- Under ‘Gitanjali’ scheme and ‘Amar Thikana Abason’ scheme 93,852 people and expenditure increased by 7.5 times

- In Jal Bharo Jal Dharo scheme, 1,18,000 ponds were dug, target was 50,000

- The supply of Drinking Water has increased by 252% in the last 3 years. The expenditure was Rs 470 crore (2010-11). We have started 615 projects for the rural water projects, which is double from 2010-11

- We set up 95 Fair Price Medicine Shops from which 1 Cr 30 lakh people benefited worth Rs 364 crore.

- 418 new primary schools and 1438 HS schools have been set up

- 1618 Madhyamik schools upgraded to HS schools

- 319 Junior schools upgraded to Madhyamik schools

- 85,000 new classrooms set up in schools of West Bengal

- There were 13 Universities in West Bengal since 1947, in 3 years we have set up another 13

- There were 32 new colleges since 1947, we set up 40 new colleges in 3 years, since 2011, 43 new ITIs set up besides the 83 present, new 92 ITIs are underway

- Since Independence only 62 ITIs are there. In the last 3 years we have set up 34 new ITIs and 32 new ITIs are coming

- Among the minority community Rs 1392 Crore given as scholarships to 65 lakh needy students, which is 8 times than the previous Government

- 22 lakh girl child have been registered in Kanyashree scheme and 20 lakh girl child already benefited

- West Bengal has been in the top position in Skill Development in 2013 and 2014

- Online registration for obtaining caste certificates started of which 2.74 lakh caste certificates of Tapashili caste are already distributed

- The number of cycles given to tribal students is 10 times more than the previous Government

- 45 lakh Unorganised Sector workers brought under the ambit of social security benefits

- Rs 359 Cr has been given to 12 lakh workers in Unorganised Sector as social security benefits, which is 40 times more than the amount spent in 2001-2011.

- Before 2011, there was 385 km rural roads, during 2013-14, the length increased by 4 times to 2631 km, 1270 kms converted to two lanes and 2672 kms broadened

- The expenditure on roads and bridges have increased by 3 times

- The Asian Highway 2 connecting Nepal border with Bangladesh border worth Rs 600 crores and Asian Highway 48 connecting Bhutan border with Bangladesh border worth Rs 900 crore have already commenced

- Birth-death certificates, trade license etc are to be given through online portal in municipal areas.

- Rs 3420 crore has been given for 22 new townships. Investment proposal worth Rs 76000 crore received

- The new district, Alipurduar created, Uttar Kanya, the North Bengal Secretariat set up

- Uttar Banga Business Summit received proposal of Rs 2200 crore for investments and another Rs 1700 crore in MSME

- Special emphasis is given in the 74 backward blocks of the 5 districts of western region. Out of the 260 project, work for 152 schemes have already been completed

- For irrigation, a new project ‘Krishi Bandhu’ worth Rs 500 crore set up.

- In Tourism, Planned Expenditure increased 20 times from 2010-11 to Rs 223 crore in 2014-15

- New international carriers have started services like Dragon Air, Silk Air

- Air Traffic at Bagdogra and Asansol have increased

- 874 new buses are now on the roads boosting transport

- Eco Park, International Convention Center set up at Rajarhat

- Sales Tax has been reduced for Aviation Turbine Fuel

- For Kolkata airports sales tax over fuel reduced from 30% to 15%. The measures have helped to increase

- 8 IT parks are on the verge of competition, another 7 are coming up. 2 electronic manufacturing hub have been sanctioned and one hardware park will be set up within 2015

- In case of ‘big industries’ the investment under implementation or already implemented stands at Rs 84,211 crore from the stage F0 to F6, as i have explained earlier in the Assembly

- In addition to this investment proposals worth Rs 55855 crore has been received earlier, and in the Bengal Global Business Summit proposal of Rs 2,43,000 crore have veen received, thus making a total of Rs 3,00,000 crore.

- The bank lending to MSME has grown to a record high of Rs 40,713 crore, which is about 3 times.

- In 2012-13 and 2013-14, this growth rate is the highest in India

- The number of MSME clusters have increased by 3 times from 54 to 161

- 531075 numbers of weavers identity card have been provided

Allocations

– Food & Supplies – Rs 202 crore in 2015-16 from Rs 175.2 crore in 2014-15

– Agriculture Rs 1500 crore in 2015-16 from Rs 1157 crore in 2014-15

– Food Processing – Rs 138 crore in 2015-16 from Rs 120 crore in 2014-15

– Water Supply – Rs 450 crore in 2015-16 from Rs 356.85 crore in 2014-15

– Fisheries – Rs 218.1 crore in 2015-16 from Rs 196 crore in 2014-15

– Irrigation – Rs 2041 crore in 2015-16 from Rs 1872.49 crore in 2014-15

– Water Resources – Rs 528 crore in 2015-16 from Rs 466.52 crore in 2014-15

– Forest – Rs 271 crore in 2015-16 from Rs 225 crore in 2014-15

– Health – Rs 2580 crore in 2015-16 from Rs 2211 crore in 2014-15

– School Education – Rs 8055 crore in 2015-16 from Rs 6844 crore in 2014-15

– Women Dev – Rs 863.98 crore in 2015-16 from Rs 720.76 crore in 2014-15

– Labour – Rs 250 crore in 2015-16 from Rs 220 crore in 2014-15

– Sports – Rs 180 crore in 2015-16 from Rs 142 crore in 2014-15

– Youth Dev – Rs 160 crore in 2015-16 from Rs 130 crore in 2014-15

– Home – Rs 273 crore in 2015-16 from Rs 245 crore in 2014-15

– Culture – Rs 200 crore in 2015-16 from Rs 165 crore in 2014-15

– Urban Dev – Rs 1895 crore in 2015-16 from Rs 1585 crore in 2014-15

– Transport – Rs 450 crore in 2015-16 from Rs 400 crore in 2014-15

– Child Dev – Rs 2809 crore in 2015-16 from Rs 2420 crore in 2014-15

– Electricity – Rs 1295 crore in 2015-16 from Rs 1174 crore in 2014-15

– Municipal Affairs – Rs 2464 crore in 2015-16 from Rs 2251 crore in 2014-15

– Minority Dev – Rs 2033 crore in 2015-16 from Rs 1737 crore in 2014-15

– Backward Class Welfare – Rs 483 crore in 2015-16 from Rs 377 crore in 2014-15

– North Bengal Dev – Rs 450 crore in 2015-16 from Rs 375 crore in 2014-15

– Sundarbans Dev – Rs 370 crore in 2015-16 from Rs 300 crore in 2014-15

– MSME – Rs 618 crore in 2015-16 from Rs 536 crore in 2014-15

– Industry and Business – Rs 653.5 crore in 2015-16 from Rs 544 crore in 2014-15

- WB received CSI Award for governance and ranked 1st in the category ‘Excellence in e-Governance’

- VAT registration threshold has been increase from 5 lakhs to 10 lakhs, 20000 small business to be benefited

- A host of steps to simplify VAT registration, appeal, refund etc taken up

- Input Tax Credit to be extended to the manufacturers

- Threshold of additional stamp duty for registering properties raised to Rs 40 lakh instead of Rs 30 lakh

- Entertainment Tax relief increased to Rs 100 for music show, magic shows

- 20 lakh hectres of new land to be brought under irrigation

- The scholarship for Kanyashree raised to Rs 750 from Rs 500

- The pensions for Samajik Mukti Card holders have been increased in various steps

- Transport Workers are from now on entitled to avail Samajik Mukti Cards

- 10 years of Tax Relief will be given to providers of Green Electricity

- In the last year, we could create 16.6 lakh employment, in the coming year expecting 17.5 lakh employment